Anjing Road, Xiaolan, Zhongshan, Guangdong, China

info@mes-drive.com

08.00 AM-09.00 PM

Introduction

On October 3rd, 2024, the world celebrated a milestone that captured headlines across every major news platform: the worldwide electric‑vehicle (EV) fleet surpassed 10 million cars, a record that underscored the rapid adoption of cleaner transportation. The breakthrough was fueled by a confluence of factors—improved battery chemistry, generous subsidies, expanding charging infrastructure, and, crucially, advances in the mechanical components that translate electric power into motion. Among these, the humble gear motor, or reducer motor, quietly delivers the torque, speed, and precision adjustments that make electric drivetrains efficient and reliable. In this article we examine how the surge in EV popularity intersects with the demand for high‑performance gear motors, exploring both market dynamics and technical innovations that keep the wheels turning.

Why Gear Motors Matter in the EV Era

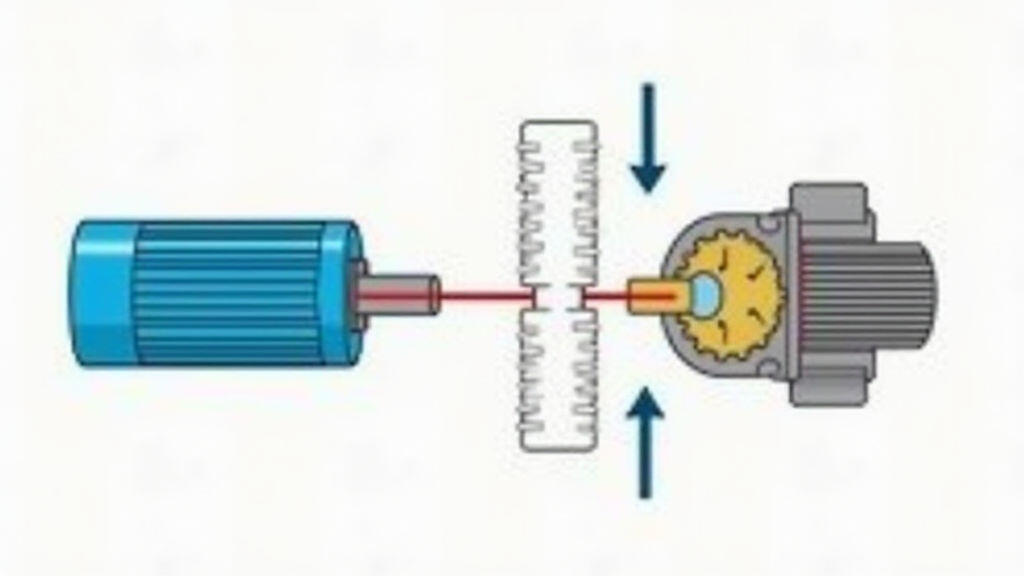

Unlike gasoline engines that naturally produce a wide range of torque across many RPMs, electric motors generate peak torque instantly but decline rapidly at higher speeds. To make the most of this power profile, manufacturers couple the motor with a gear reducer that shifts the high‑speed, low‑torque output into a more usable range for the wheels. This coupling improves acceleration, enhances torque management for regenerative braking, and ensures that the final drive can handle the varying load conditions of urban or highway driving.

Historically, gear motors were verbose, bulky, and consumable. Today’s gear reducers—crafted with advanced spindles, planetary gearsets, and low‑friction bearings—are lightweight, compact, and feature precise encoders that enable closed‑loop control. These refinements reduce mechanical losses, lower noise levels, and extend the unit’s life span—all critical factors as EV makers push for higher mileage and customer comfort.

The Trending Factor: Record‑Breaking EV Sales and the Push for Four‑Wheel Autonomy

Beyond the raw numbers, the EV surge carries an additional layer of urgency: autonomous, driver‑less vehicles. Bloomberg and Reuters reported that the U.S. and China together launched over 50 autonomous model pods last month alone, with global sales projected to exceed $200 billion by 2027. Autonomous driving systems rely on high‑precision steering, braking, and acceleration controls—all tasks dependent on responsive gear motors. As sensor suites become more sophisticated, the ability to modulate outputs in real time with sub‑millimeter accuracy becomes indispensable.

Because gear motors sit at the nexus of mechanical actuation and electronic control, they now receive a “second look” from automotive suppliers. Analysts note that the market for reducer motors in electric drivetrains is growing at an annual rate of 12 %—twice the pace of the broader motor assembly segment.

Technical Advancements Driving Adoption

1. Integrated Controllers and Firmware

Modern gear motors bundle micro‑controllers that translate torque‑sensor data into micro‑adjustments, allowing FOR every EV to achieve smoother acceleration curves and more responsive regenerative braking. This integration reduces wiring complexity and improves system reliability—a crucial advantage when millions of units will be mass‑produced.

2. Smart Material Use

Lightweight composites like carbon‑fiber reinforced polymers are increasingly used in gear housings, cutting mass by up to 30 % while maintaining structural integrity. Combined with high‑strength steel for meshing teeth, the benefit is obvious: lighter cars result in lower energy consumption and better range.

3. Advanced Thermal Management

As power densities climb, heat becomes a limiting factor for durability. High‑performance gear motors now incorporate liquid‑cooling channels and phase‑change materials to dissipate heat efficiently, extending component life even under aggressive acceleration demands.

4. Scalable Manufacturing

Additive manufacturing—particularly the use of 3D‑printed metal components—has cut tool change times and enabled rapid prototyping of complex gear profiles. This flexibility allows suppliers to respond quickly to changing specifications from OEMs, an essential capability as regulatory standards and driver expectations evolve.

Industry Perspectives and Market Outlook

According to a recent MarketWatch survey, 68 % of EV OEMs now consider gear motors “critical” to their competitive advantage. Samsung, Bosch, and GKN Fuso have announced joint ventures focused on producing next‑generation reducer motors with integrated sensors, hinting at a future where mechanical and electronic controls become inseparable. Meanwhile, supply‑chain analysts fear potential disruptions: the high concentration of gear‑motor‑steel producers in Europe and China could be vulnerable to geopolitical shifts.

From a consumer viewpoint, the benefits are tangible: quieter rides, smoother pedal feel, improved fuel efficiency, and reliable regenerative braking—all translating into lower operating costs and a better user experience. For the OEM, integrating smarter gear motors reduces cooling system demands, enabling slimmer vehicle profiles and higher payload capacity.

Conclusion

The record 10 million‑plus EVs on the road is more than a milestone—it’s a turning point that places gear motors in the spotlight. As autonomous systems evolve and consumers demand higher performance with lower costs, retailers look toward efficient, compact, and smart reducer motors as the backbone of next‑generation automotive drivetrains. Whether through advanced materials, integrated controls, or smarter manufacturing, the gear motor adapts to meet the challenge of a cleaner, more connected transportation future. Its unassuming presence belies the crucial role it plays in turning electric energy into motion, steering the global automotive industry toward a more sustainable horizon.

Leave A Reply

Your email address will not be published. Required fiels are marked